FEBRUARY 2025

REAL ESTATE MARKET UPDATE

CONTACT US:

425-236-6777

Pending Home Sales Pull Back From Best Levels Since April 2023

The real estate market is currently experiencing a period of relative stability, with some fluctuations and trends emerging. Pending home sales have recently pulled back slightly from peak levels seen last spring, but this is considered a normal market dynamic. While some headlines focus on past months like November and December, the current focus is on real-time data to understand the market's immediate direction. National headlines indicate that home price appreciation exceeded expectations in November, and while mortgage rates had been at their lowest point in over a month, they have since leveled out at around 7%. This rate, while seemingly high, is actually trending downwards, which is a positive sign.

Despite some concerns about a potential market crash reminiscent of 2008, current conditions paint a different picture. Lending practices are far more stringent now than they were then, with safeguards like "stress tests" in place to ensure borrowers can handle financial pressures. There's no evidence of a surge in foreclosures or an overwhelming influx of homes hitting the market. Instead, the market is exhibiting typical seasonal patterns. While there have been some price reductions, this is also a normal occurrence, especially as interest rates influence affordability.

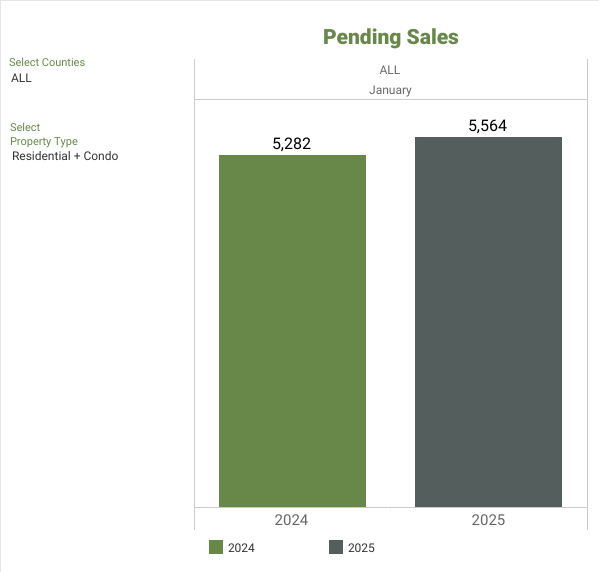

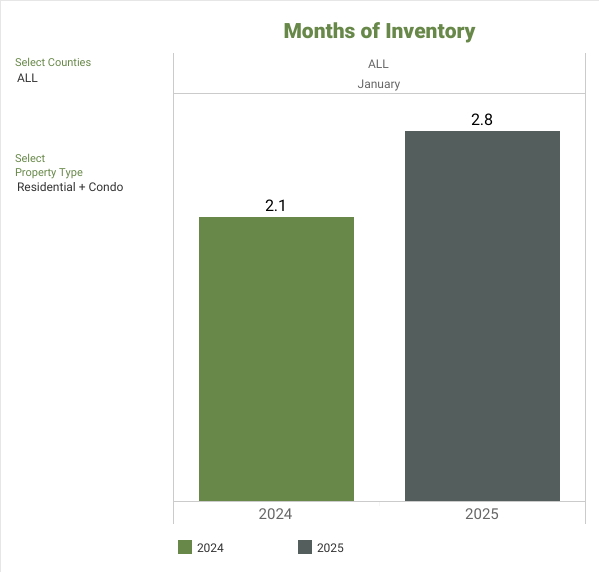

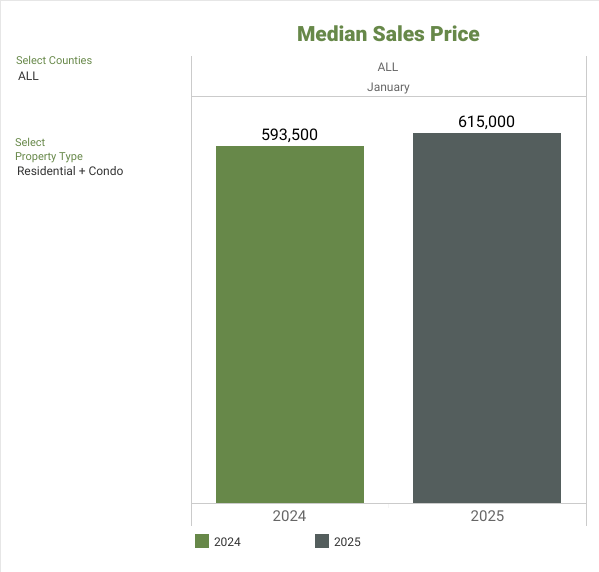

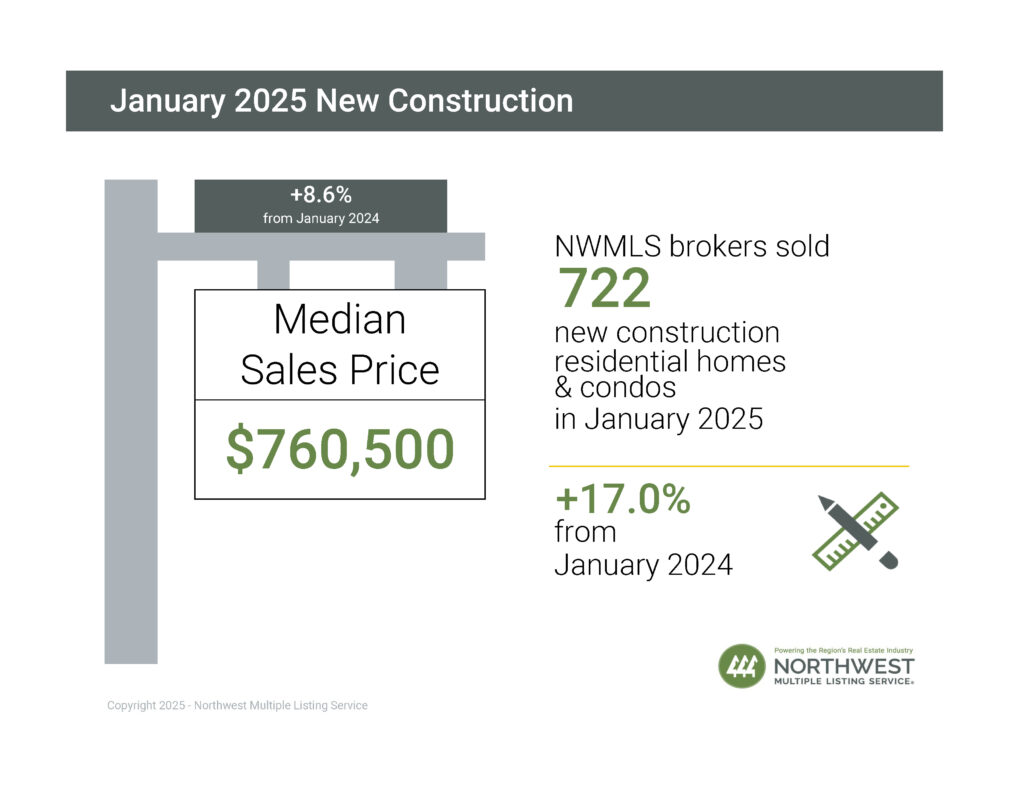

Analyzing key metrics reveals a balanced market with healthy activity. New listings are being matched by pending sales, indicating strong demand. While sold prices have recently dipped slightly, this is attributed to interest rate fluctuations affecting buyer budgets, not necessarily a sign of declining values. Year-over-year and month-over-month, both list and sold prices have generally trended upwards, reflecting seasonal norms. New construction is also seeing increased activity, with builders offering incentives to attract buyers.

Overall, the real estate market is currently stable and behaving as expected for this time of year. While some fluctuations exist, they are within the range of normal seasonal variations. The low number of bank-owned homes and the responsible lending practices in place suggest a fundamentally different market than the one that experienced the 2008 crash. As interest rates potentially decrease in the coming months, the market is poised for further activity and growth, particularly in the spring season.

The real estate market is currently experiencing a period of relative stability, with some fluctuations and trends emerging. Pending home sales have recently pulled back slightly from peak levels seen last spring, but this is considered a normal market dynamic. While some headlines focus on past months like November and December, the current focus is on real-time data to understand the market's immediate direction. National headlines indicate that home price appreciation exceeded expectations in November, and while mortgage rates had been at their lowest point in over a month, they have since leveled out at around 7%. This rate, while seemingly high, is actually trending downwards, which is a positive sign.

Despite some concerns about a potential market crash reminiscent of 2008, current conditions paint a different picture. Lending practices are far more stringent now than they were then, with safeguards like "stress tests" in place to ensure borrowers can handle financial pressures. There's no evidence of a surge in foreclosures or an overwhelming influx of homes hitting the market. Instead, the market is exhibiting typical seasonal patterns. While there have been some price reductions, this is also a normal occurrence, especially as interest rates influence affordability.

Analyzing key metrics reveals a balanced market with healthy activity. New listings are being matched by pending sales, indicating strong demand. While sold prices have recently dipped slightly, this is attributed to interest rate fluctuations affecting buyer budgets, not necessarily a sign of declining values. Year-over-year and month-over-month, both list and sold prices have generally trended upwards, reflecting seasonal norms. New construction is also seeing increased activity, with builders offering incentives to attract buyers.

Overall, the real estate market is currently stable and behaving as expected for this time of year. While some fluctuations exist, they are within the range of normal seasonal variations. The low number of bank-owned homes and the responsible lending practices in place suggest a fundamentally different market than the one that experienced the 2008 crash. As interest rates potentially decrease in the coming months, the market is poised for further activity and growth, particularly in the spring season.

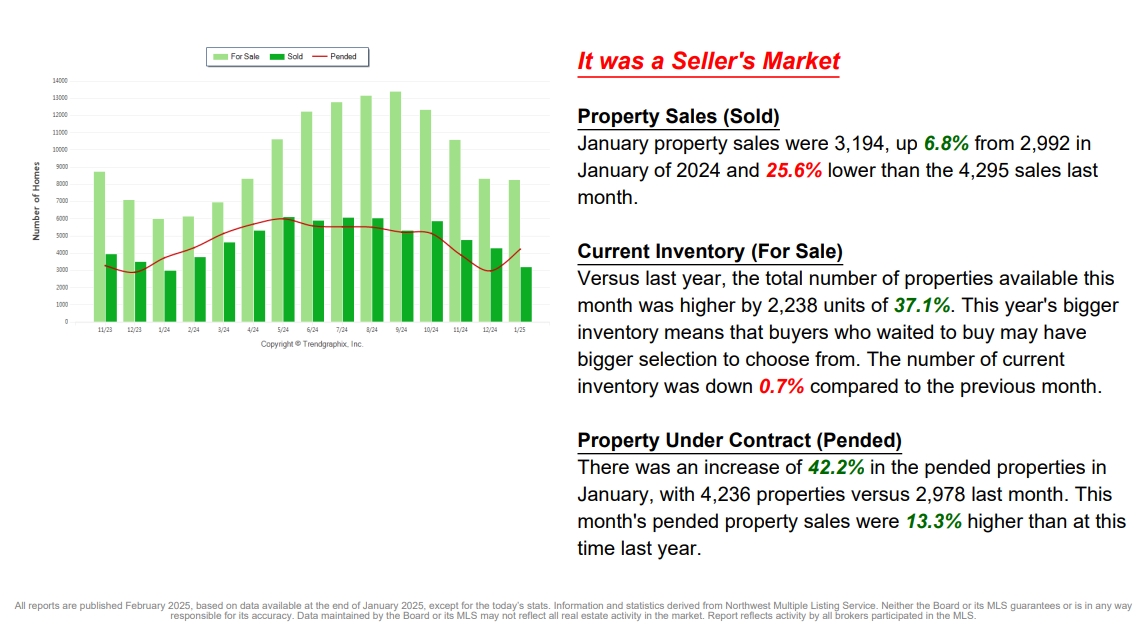

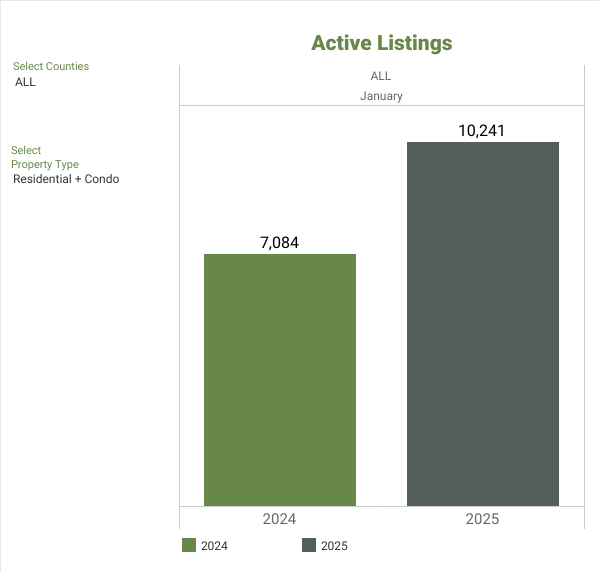

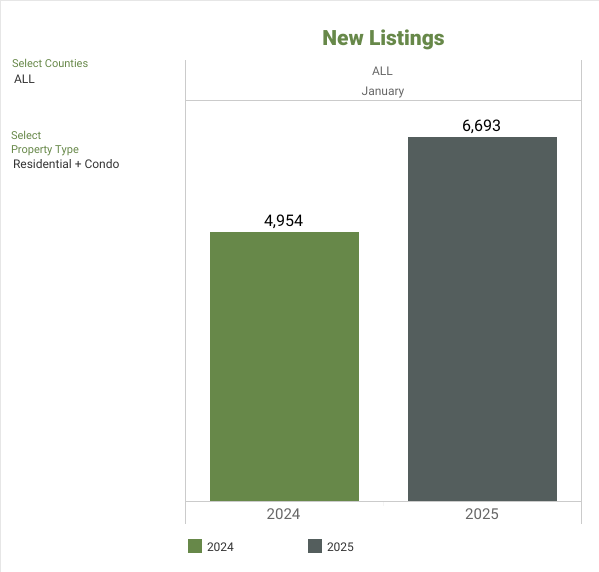

NWMLS Market Snapshot - JANUARY 2025

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing? Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates